Not All RIA Custodians Approach Data the Same Way.

Do you own your client data? This can be a loaded question for many RIAs.

RIA client data comes in many forms – while some data may be readily accessible to your business, other data may be harder to get your hands on.

Understanding what data you have access to and how to leverage it for your business can be a crucial step for advisors looking to reach the next level for their RIA.

That’s why TradePMR joined with industry veterans Joel Bruckenstein, Technology Tools for Today, and John O’Connell, The Oasis Group, to develop a webinar and white paper on RIA firm data. Joel and John set out to answer some of advisors’ biggest questions about data:

- How can RIAs safely store client data?

- What data formats work best for analysis?

- What is the value of data in providing a better client experience?

- How can data drive a higher valuation for RIAs?

- What client data are RIA custodians willing to share?

Determining Data Ownership

Before RIAs can store and analyze client data, they need to determine what data they can access. Advisors may be surprised to learn that not all RIA custodians and third-party providers approach data the same way.

Each technology vendor an advisor engages with has its own policies and procedures. These policies can impact how providers approach important points like data storage, data redundancy and security protocols.

Some RIA custodians may be more closed off in their approach to advisory firm data, only allowing client data to be shared at a certain cadence (like end-of-day or end-of-quarter), or potentially limiting which data points the firm is willing to share.

As outlined in the webinar and white paper, the applications of data are expansive and can possibly help RIAs achieve their next stage of growth. A restricted approach to data sharing from an RIA custodian can significantly limit how advisors can leverage that data for their practices.

Not only is data analysis an important arrow in an RIA’s quiver, it’s increasingly becoming a core strategy to remain competitive in the current market. While major financial institutions and large RIAs have been leveraging data for years, it seems as though smaller to mid-size RIAs have been relatively slow to adopt. Trade PMR believes accessing and leveraging this client data can be critical for RIAs looking to win clients and compete with some of the industry’s largest providers.

TradePMR’s Approach to Data

TradePMR believes that RIA firm data is just that: the RIA’s data.

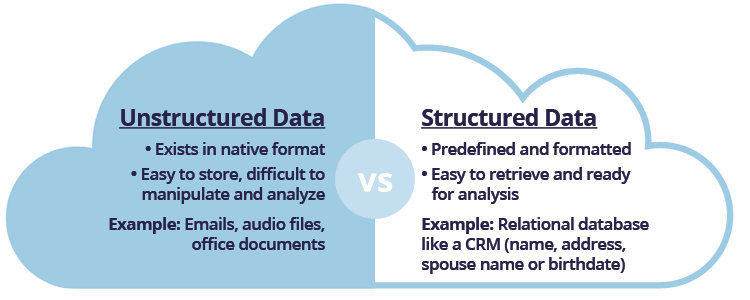

The provider offers the ability for advisory firms to receive nightly files with client positions and balances. While some providers only share unstructured, raw data, TradePMR works with advisors to determine how they would like to receive their data. This data from TradePMR can be imported into structured databases, for example, to be readily leveraged by advisory firms for analysis.

By joining custodial data from TradePMR with customer data held by an RIA’s CRM, advisors can potentially generate deeper insights into their firm’s client base. This can help advisors to better understand points like demographic concentrations among clients and holdings across the firm’s entire client-base.

Understanding these points through data analysis can influence everything from investment philosophy to client interactions to long-term growth goals.

In addition to the webinar and white paper, TradePMR has developed a worksheet with key data questions that advisors can take to their RIA custodians. These questions are designed to help the advisor uncover how their current provider approaches data, what client data their team can access, and what data points their provider considers to be off-limits.

Are You Ready to Unlock the Power of Data?

If you feel that your RIA custodian could do more to help your firm leverage data, we should talk.

We can dive into TradePMR’s data policies, approach to data sharing, and what data analysis could do for your team and your clients.

Trade-PMR, Inc, member FINRA/SIPC

Joel Bruckenstein, Technology Tools for Today, and John O’Connell, The Oasis Group are not affiliated or associated with Trade-PMR, Inc. Securities are offered through Trade-PMR, Inc.

Editor’s note: This post was originally published in March 2022 and has been subsequently updated.