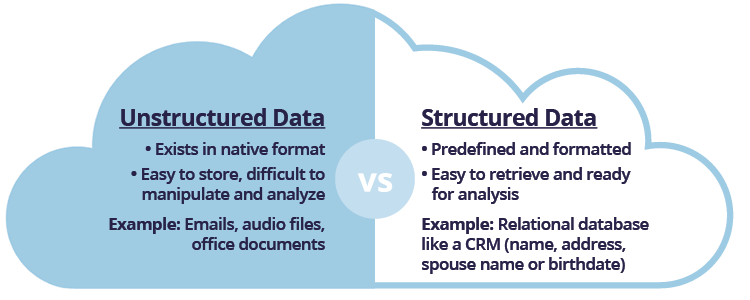

RIA firm data can influence everything from operations to client service to firm valuation. But before advisors can look to analyze and utilize that data, they need to figure out what data they have. One of the first points about data that we need to clarify is how that data is formatted. Data sets can be considered either structured or unstructured.

While both structured and unstructured data are important and can be valuable for your firm, the ways that these different types of data can be used, and how ready they are for analysis, can be vastly different.

On top of understanding what these types of data are, it’s important to determine what data you own, and how your third-party vendors approach your firm’s data. TradePMR recently joined with Joel Bruckenstein, president of Technology Tools for Today, and John O’Connell, founder of The Oasis Group, to focus in on these points in a white paper and webinar.

So, what is the difference between unstructured and structured data? Let’s dive in.

Unstructured Data

Data that is unstructured means data that exists in its native format. This can include items like emails and office documents, as well as video and audio files. This data is easy to accumulate and store but can be difficult to analyze.

Without predefined fields and standardized structure for this data, the ways advisors can utilize unstructured data are limited. Having access to these individual files is certainly helpful on an ad-hoc basis, like reviewing call notes from a client conversation to jog your memory before a quarterly meeting. Unfortunately, there is little advisors can do to leverage this unstructured data at scale without expending significant time and resources to reformat the data.

Structured Data

Structured data can be a great tool for RIAs. This type of data has been predefined and formatted into a set structure before being placed into data storage. A good example of structured data is a relational database, wherein data has been formatted into fields like name, address, and birthdate. A perfect example is a nice clean, formatted Excel spreadsheet.

Structured data has a few key benefits for RIAs:

- Accessible for Business Users – a structured format enables users to manipulate data sets without a deep knowledge of database technology. At the end of the day advisors are not data experts, so the easier this data is to analyze, the better.

- Can be Analyzed Using Formulas – advanced technologies can produce analysis on structured datasets in a matter of seconds. This analysis can unlock valuable insights for RIA’s, helping to provide a deeper understanding of the health of their business and identify opportunities to improve their operations.

- Can Develop Insights with Machine Learning – beyond analyzing existing data, machine learning can help to identify patterns in behaviors among an advisor’s client-base and can suggest actions based on those findings. This can lead to more robust Next Best Action initiatives, helping advisors to anticipate client needs before they have them.

What data do you have access to?

Not all third-party providers approach data the same way.

While TradePMR looks to offer data to advisors in a structured format that they can readily use, other providers may only offer the unstructured data files. What’s more, these other vendors may limit what data they allow advisors to access.

TradePMR believes RIA firm data is just that – the RIA’s data. We work to offer advisors all the information they need to secure data-driven insights to enhance their operations, client service and valuation. If we can make the data analysis process easier for your firm, we’re going to do everything in our power to do just that. That starts with providing structured, usable data to advisors whenever and wherever they need it.

In our opinion, RIAs don’t just need data, they need data that their firms can actually use delivered in a way that makes sense for their business. At the end of the day, we’re focused on supporting your firm. And when it comes to data, that means we want to provide you with information that your firm can readily analyze, and that can deliver valuable insights to help you grow, improve your operations, and drive a higher valuation for your business.

Not sure where your current provider stands on data? By asking your vendors a few key questions you can determine what data you have access to, and how that data can be shared with your firm.

Interested in learning more about what data can do for your business, and how TradePMR approaches RIA firm data? Let’s talk.